….participate in India Real Estate Story

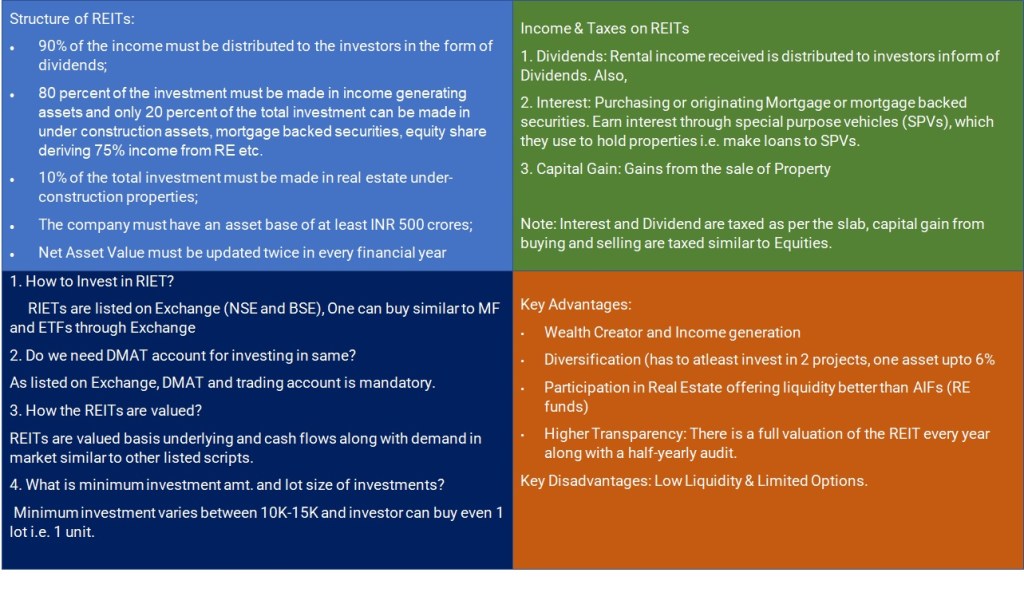

REITs are the trust that “OWN, OPERATE & FINANCE” the Real Estate, giving an opportunity to retail investor to participate in the RE and offering:

- Partial ownership in the assets held by the Trust

- Wealth Creation and regular income to unitholders.

- Structure is similar to Mutual Funds & ETFs.

- Higher liquidity comparisons to other mode of investment in Real Estate as also listed on exchange.

With shrinking debt returns, investors are looking for alternate avenues of investments that is offering capital appreciation and regular income to investors. REITs has evolved in Indian market majorly in last 3 years, with only 3 options currently in market participating in commercial real estate.

5-10% of allocation in portfolio will lead to diversification of returns and risk.

With opening of offices and covid may be behind us, REITs may be benefitted with better rental yields, higher interest income with rates hikes & capital appreciation.

Leave a comment